Time For Investing? Why Investing In Luxury Watches Should Be In Your 2023 Investment Plans

Time for Investing?

With such a volatile and unpredictable economy going into the last half of this year, I’m sure just like ourselves, you are wondering if there are any safe investment opportunities that are worthwhile. Where we would normally turn to property, bonds, or even commodities like gold…there is another asset class worth considering.

Luxury watches from any reputable brand have proven to be an amazing investment vehicle for growth and a store of value in recent years.

But why invest in Watches?

Not only are there many benefits from an investment and tax perspective, watches are an asset that can be enjoyed, and once you step in to the horological world, you’ll never look back.

Bear in mind, watches can always be traded, exchanged and upgraded, meaning options are endless for exploring different brands that offer a different feel every time you put it on your wrist. As watches are made at the highest quality, they stand to last a lifetime, and if you aren’t buying for the sentimental value, its always nice to know that in the future it can be sold to generate a budget for a new model.

More often than not, watches can be seen as a hobby that generates money in the future. The deep research, the hunting, the acquisition, the buying and wearing are all feats of an enjoyable process that differs from any traditional stock or crypto investment. It requires more engagement and natural curiosity to understand the watch, and of course, you can always enjoy it in the meanwhile.

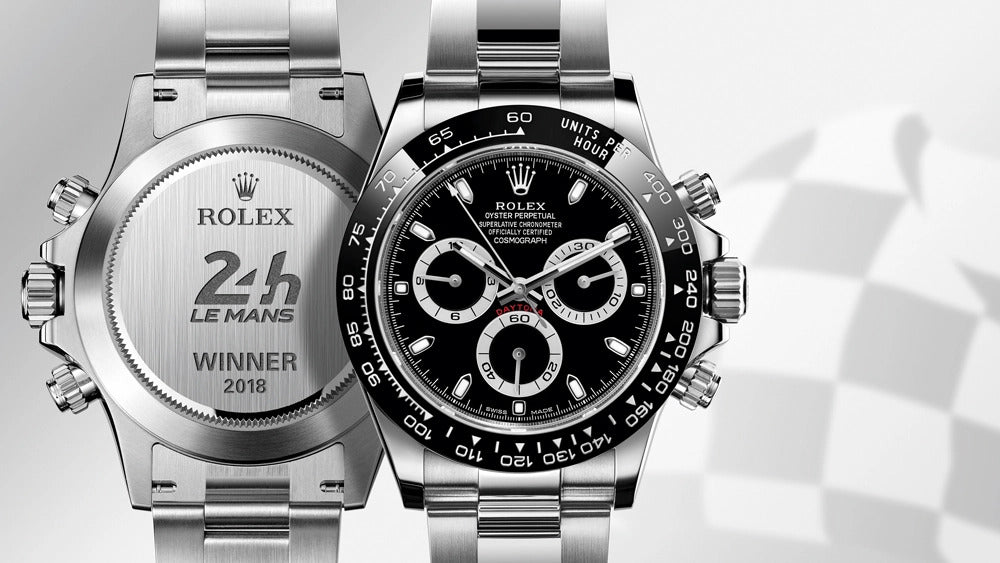

A fast growing Investment

According to Bloomberg & the Boston Consulting Group Inc — Prices for Rolex, Patek Philippe and Audemars Piguet have appreciated by 20% a year since mid-2018, outpacing the S&P 500 Index which provides 8% annual returns. This means that watches from these top Swiss brands grew at over twice the pace. More impressively, these figures are despite prices for some of the pre-owned Rolex Daytona’s, Patek Nautilus and AP Royal Oaks declining by as much as a third since the market peaked in early 2022.

This is proof that watches can stand the test of time as an investment, and historically this has always been the case. When you buy the right brand and model, for example the Rolex Daytona, you can invest with confidence knowing that they have never depreciated over a long period of time. Brands have history, and a natural scarcity due to supply and demand that makes them increase in price as they get older.

High liquidity & Portable asset

What other investment can you wear on your wrist, use, and still sell for a profit? Watches have the added benefit of being a portable asset that you can enjoy while it grows in value!

On top of this they are flexible assets that can be converted into cash and sold safely in under a day, unlike cars or houses which come with the added labour of paperwork and lengthy sale times. A high liquidity asset allows for the peace of mind that whenever you may need the extra capital, or you simply do not have an interest in keeping the watch anymore, you can sell the watch without the extra stress.

This asset is insurable, so there is the extra layer of security when you are weighing the pros and cons of investing in a luxury timepiece… and remember, you can insure a Rolex, you can’t insure cash.

Tax. What Tax?

One of the most appealing benefits of watches as investments is the fact that there are no capital gains tax implications on watches in the UK no matter the profit made. This makes it great as an alternative store of value, specifically for inheritance purposes.

This ties in to the sentimental value of a watch as you may be thinking of buying it for future generations to enjoy, but you can rest assured knowing that if needs be, they can be sold with no tax implication for your children or loved ones in the future.

So what’s hot on the market at the moment?

The market has taken a dip in the last year after there were record market highs in the 2022 surge. This has made the watch market much more accessible with friendlier entry price points for the majority of brands, which were artificially high during the market peak.

With this being said, Rolex, Audemars Piguet and Patek Philippe are all as lucrative as ever on the market, despite watch prices having dropped. Specifically the Rolex stainless steel sports models, Patek Philippe Nautilus and Aquanaut, and Audemars Piguet Royal Oak’s. They are all proven to fetch significant premiums in the current market, especially if you were fortunate enough to purchase them from retail.

Timing the market correctly can be beneficial when it comes to these pieces. As any other market, it comes in ebbs and flows. Buying cheap and selling high can always be achieved, for example in early 2022 the Rolex Sky-Dweller blue dial reference 326934 reached a market high of £35,000 only retailing for £12,500.

This watch today is standing around £20,000 on the market for its latest model, which shows there is always room for growth considering the market peak. This is something to consider and analyse when you are investing in the watch space.

This year Richard Mille has been an excellent choice from an investment perspective, with returns well over 20% for the majority of the popular models such as the RM 030 and RM 11-03. For example, the RM 11-03 rose gold in March 2021 would have been valued around the £270,000 mark, but only a year after this watch grew in value to £350,000, then reaching the market high of £380,000 in the summer of 2022. There aren’t many investments in a year that return over 40%.

There’s so many layers to the watch market that can be discovered, and hopefully by the end of this read you will take away a few pointers of what to look out for. But, more importantly, you can take away that this is the one asset that can be enjoyed as a status symbol that no other alternative asset (other than the odd Ferrari), will grow as you have it on your wrist.